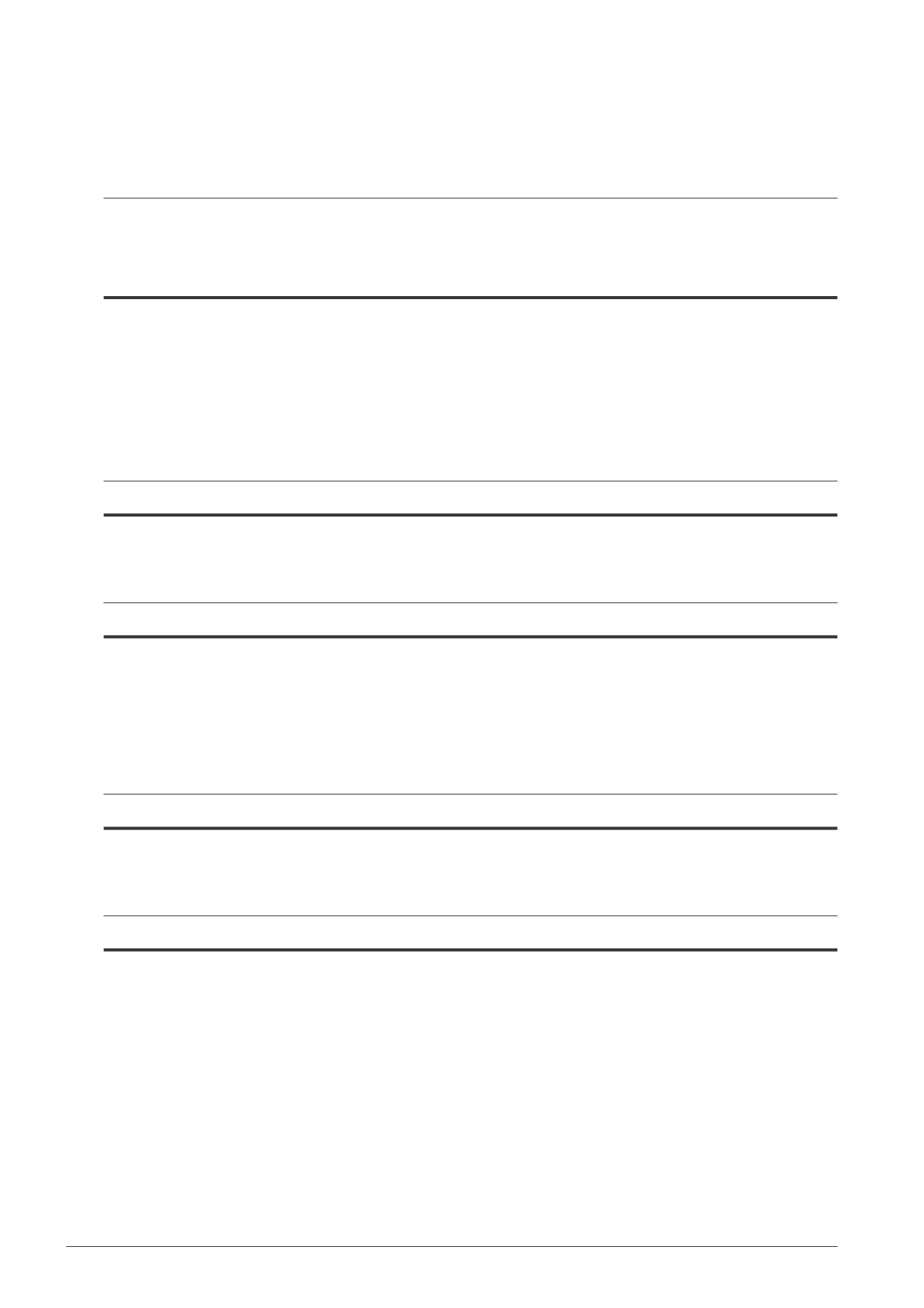

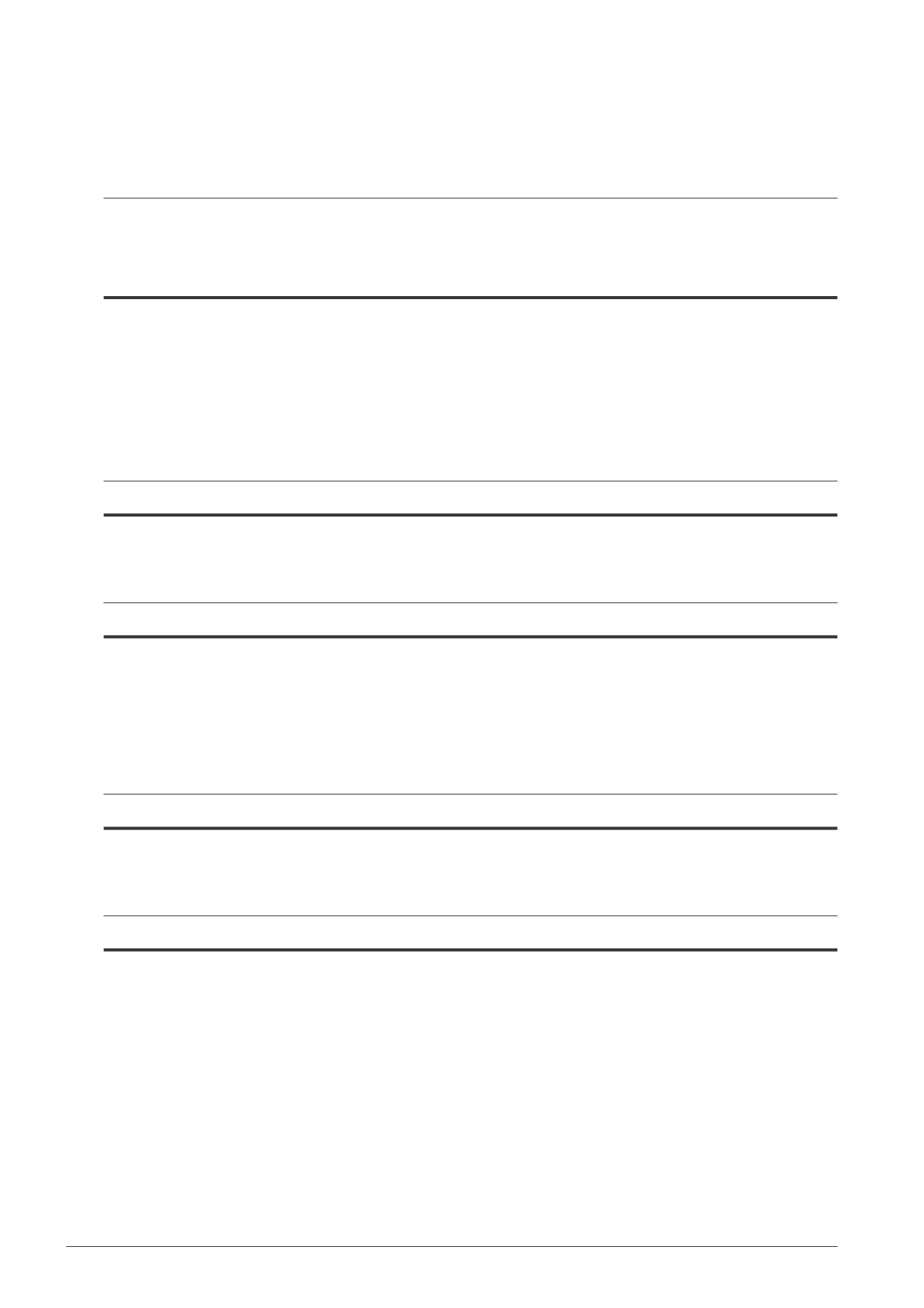

27. CAPITAL AND FINANCIAL RISK MANAGEMENT

(continued)

Accounting classifications and fair values

(continued)

Fair values versus carrying amounts

(continued)

Note

Loans and

receivables

Fair value –

hedging

instruments

Other financial

liabilities

within scope

of FRS 39

Total

carrying

amount

Fair value

$’000

$’000

$’000

$’000

$’000

Trust

2014

Non-trade amounts due from

subsidiaries

6

18,693

–

–

18,693

18,693

Trade and other receivables

7

201

–

–

201

201

Cash and cash equivalents

8

238

–

–

238

238

Financial derivative assets

11

–

1,547

–

1,547

1,547

19,132

1,547

–

20,679

20,679

Trade and other payables

9

–

–

5,386

5,386

5,386

Interest-bearing borrowings

10

–

–

566,823

566,823

568,053

Financial derivative liabilities

11

–

8,605

–

8,605

8,605

–

8,605

572,209

580,814

582,044

2013

Non-trade amounts due from

subsidiaries

6

17,954

–

–

17,954

17,954

Trade and other receivables

7

219

–

–

219

219

Cash and cash equivalents

8

249

–

–

249

249

Financial derivative assets

11

–

2,044

–

2,044

2,044

18,422

2,044

–

20,466

20,466

Trade and other payables

9

–

–

9,060

9,060

9,060

Interest-bearing borrowings

10

–

–

474,383

474,383

477,549

Financial derivative liabilities

11

–

5,208

–

5,208

5,208

–

5,208

483,443

488,651

491,817

Notes to the Financial Statements

142 | CapitaRetail China Trust Annual Report 2014