THE MANAGERCorporate Governance

Our Role

We, as the manager of CLCT (Manager), set the strategic direction of CLCT and its subsidiaries (CLCT Group) and make recommendations to HSBC Institutional Trust Services (Singapore) Limited, in its capacity as trustee of CLCT (Trustee), on any investment or divestment opportunities for CLCT and the enhancement of the assets of CLCT in accordance with the stated investment strategy for CLCT. The research, evaluation and analysis required for this purpose are coordinated and carried out by us as the Manager.

As the Manager, we have general powers of management over the assets of CLCT. Our primary responsibility is to manage the assets and liabilities of CLCT for the benefit of the Unitholders of CLCT (Unitholders). We do this with a focus on generating rental income and enhancing asset value over time so as to maximise returns from the investments, and ultimately the distributions and total returns to Unitholders.

Our other functions and responsibilities as the Manager include:

- using our best endeavours to conduct CLCT’s business in a proper and efficient manner;

- preparing annual business plans for review by the directors of the Manager (Directors), including forecasts on revenue, net income and capital expenditure, explanations on major variances to previous years’ financial results, written commentaries on key issues and underlying assumptions on rental rates, operating expenses and any other relevant assumptions;

- ensuring compliance with relevant laws and regulations, including the Listing Manual of Singapore Exchange Securities Trading Limited (SGX-ST) (Listing Manual), the Code on Collective Investment Schemes (CIS Code) issued by the Monetary Authority of Singapore (MAS) (including Appendix 6 of the CIS Code (Property Funds Appendix)), the Securities and Futures Act 2001 (SFA), written directions, notices, codes and other guidelines that MAS may issue from time to time and the tax rulings issued by the Inland Revenue Authority of Singapore on the taxation of CLCT and Unitholders;

- attending to all regular communications with Unitholders; and

- supervising the property managers which perform the day-to-day property management functions (including leasing, marketing, promotion, operations coordination and other property management activities) for CLCT’s properties.

CLCT, constituted as a trust, is externally managed by the Manager. The Manager appoints experienced and well qualified personnel to run its day-to-day operations.

The Manager was appointed in accordance with the terms of the trust deed constituting CLCT dated 23 October 2006 (as amended, varied or supplemented from time to time) (Trust Deed). The Trust Deed outlines certain circumstances under which the Manager can be removed, including by notice in writing given by the Trustee upon the occurrence of certain events, or by resolution passed by a simple majority of Unitholders present and voting at a meeting of Unitholders duly convened and held in accordance with the provisions of the Trust Deed.

The Manager is a wholly owned subsidiary of CapitaLand Investment Limited (CLI) which holds a significant unitholding interest in CLCT. CLI is a leading global real estate investment manager, with a vested interest in the long-term performance of CLCT. CLI’s significant unitholding in CLCT demonstrates its commitment to CLCT and CLI’s interest as a Unitholder is aligned with that of other Unitholders. The Manager’s association with CLI provides the following benefits, among other things, to CLCT:

- strategic pipelines of property assets through, amongst others, CLI’s access to the development capabilities of and pipeline investment opportunities from CapitaLand Group’s development arm;

- wider and better access to banking and capital markets on favourable terms;

- fund raising and treasury support; and

- access to a bench of experienced management talent.

Our Corporate Governance Framework and Culture

The Manager embraces the tenets of sound corporate governance, including accountability, transparency and sustainability. It is committed to enhancing value over the long term to its stakeholders with appropriate people, processes and structure to direct and manage the business and affairs of the Manager with a view to achieving operational excellence and delivering the CLCT Group’s long-term strategic objectives. The policies and practices it has developed to meet the specific business needs of the CLCT Group provide a firm foundation for a trusted and respected business enterprise.

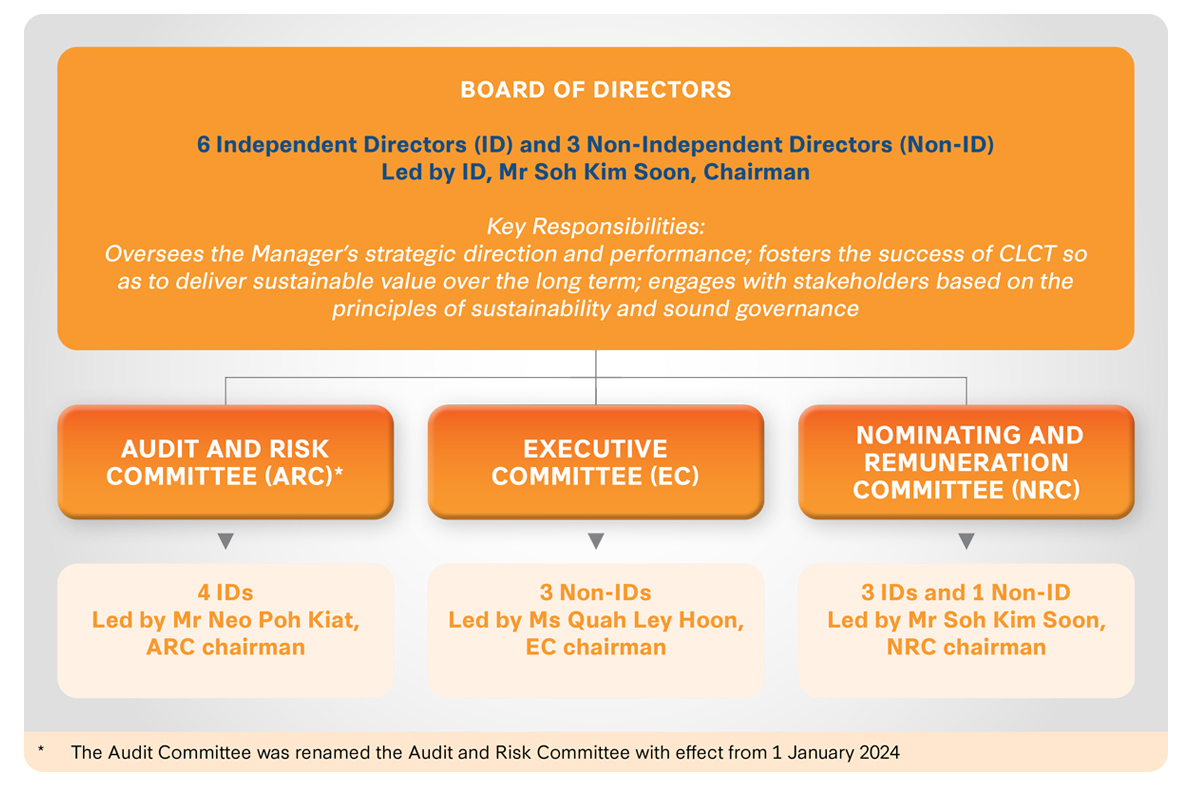

Our corporate governance framework as at the date of this Annual Report is set out below:

The Board of Directors (Board) is responsible for and plays a key role in setting CLCT’s corporate governance standards and policies. This sets the tone from the top and underscores its importance to the CLCT Group.

This corporate governance report (Report) sets out the corporate governance practices for the financial year ended 31 December 2023 (FY 2023), which are benchmarked against the Code of Corporate Governance 2018 (last amended 11 January 2023) (Code). Unless otherwise stated, this Report is based on the composition of the Board and Board Committees in FY 2023.

Throughout FY 2023, the Manager has complied with the principles of corporate governance laid down by the Code and also, substantially, with the provisions underlying the principles of the Code. Where there are deviations from the provisions of the Code, appropriate explanations are provided in this Report. This Report also sets out additional policies and practices adopted by the Manager which are not provided in the Code.

CLCT has received accolades from the investment community for excellence in corporate governance and corporate governance-related efforts.

As recognition of its commitment to environment, social and corporate governance, CLCT received a 5 Star rating for its participation in Global Real Estate Sustainability Benchmark (GRESB) Real Estate Assessment 2023 and maintained an ‘A’ for GRESB Public Disclosure 2023. CLCT has been included by SGX in the Fast Track Programme. The scheme recognises listed companies and real estate investment trusts (REITs) with good governance standards and compliance practices, and accords prioritised clearance for selected corporateaction submissions. For the Singapore Governance and Transparency Index (SGTI) 2023 assessment, CLCT was ranked 9, an improvement of 2 rankings, with a score of 98.3.

To find out more, please click on the boxes.

- BOARD MATTERS

- REMUNERATION MATTERS

- ACCOUNTABILITY AND AUDIT

- UNITHOLDER RIGHTS AND ENGAGEMENT

- ADDITIONAL INFORMATION

(A) BOARD MATTERS

-

Principle 1: The Board’s Conduct of Affairs

Board’s Duties and Responsibilities

The Board oversees the strategic direction, performance and affairs of the Manager, in furtherance of the Manager’s primary responsibility to foster the success of CLCT so as to deliver sustainable value over the long term, and to engage stakeholders based on the principles of sustainability and sound governance. It oversees the strategic direction, performance and affairs of the CLCT Group and provides overall guidance to the management team (Management), led by the Chief Executive Officer (CEO). In this regard, the Board works with Management to achieve CLCT’s objectives and long-term success and Management is accountable to the Board for its performance. Management is responsible for the execution of the strategy for CLCT and the day-to-day operations of CLCT’s business.

The Board establishes goals for Management and monitors the achievement of these goals. It ensures that proper and effective controls are in place to assess and manage business risks and compliance with requirements under the Listing Manual, the Property Funds Appendix, as well as any other applicable guidelines prescribed by the SGX-ST, MAS or other relevant authorities, and applicable laws. It also sets the disclosure and transparency standards for CLCT and ensures that obligations to Unitholders and other stakeholders are understood and met.

The Board has authority to approve key matters for CLCT including:

- material investments and divestments;

- issuance of new units in CLCT (Units), equity-linked instruments and debt instruments;

- income distributions and other returns to Unitholders; and

- matters which involve a conflict of interest for a controlling Unitholder or a Director.

The Board has established financial authority limits pursuant to which the Board reserves its authority to approve specific matters such as capital expenditure, investments, divestments and borrowings exceeding certain threshold limits, and delegates authority for matters below the Board’s approval limits to Board committees (each, a Board Committee) and Management to optimise operational efficiency. The delegation of authority is clearly communicated to Management in writing.

The Directors are fiduciaries and are collectively and individually obliged at all times to act objectively in the best interests of CLCT. Consistent with this principle, the Board is committed to ethics and integrity of action and has adopted a Board Code of Business Conduct and Ethics (Board Code) which provides that every Director is expected to, among other things, adhere to the highest standards of ethical conduct. All Directors are required to comply with the Board Code. This sets the appropriate tone from the top in respect of the desired organisational culture, and ensures proper accountability within the Manager. In line with this, the Board has incorporated in the Board Code a standing policy that a Director must not allow himself or herself to get into a position where there is a conflict between his or her duty to CLCT and his or her own interests and, in this regard, a Director is required to disclose to the Board his or her interests in any transaction to which CLCT is a party, and any other conflicts (including potential conflicts) of interest. Where a Director has an interest in a transaction or a conflict (including potential conflict) of interest in a particular matter, he or she will be required to disclose his or her interest to the Board, recuse himself or herself from deliberations on the transaction or matter and abstain from voting on the transaction or matter. During FY 2023, every Director has complied with this policy, and where relevant, such compliance has been duly recorded in the minutes of meetings or, as the case may be, written resolutions.

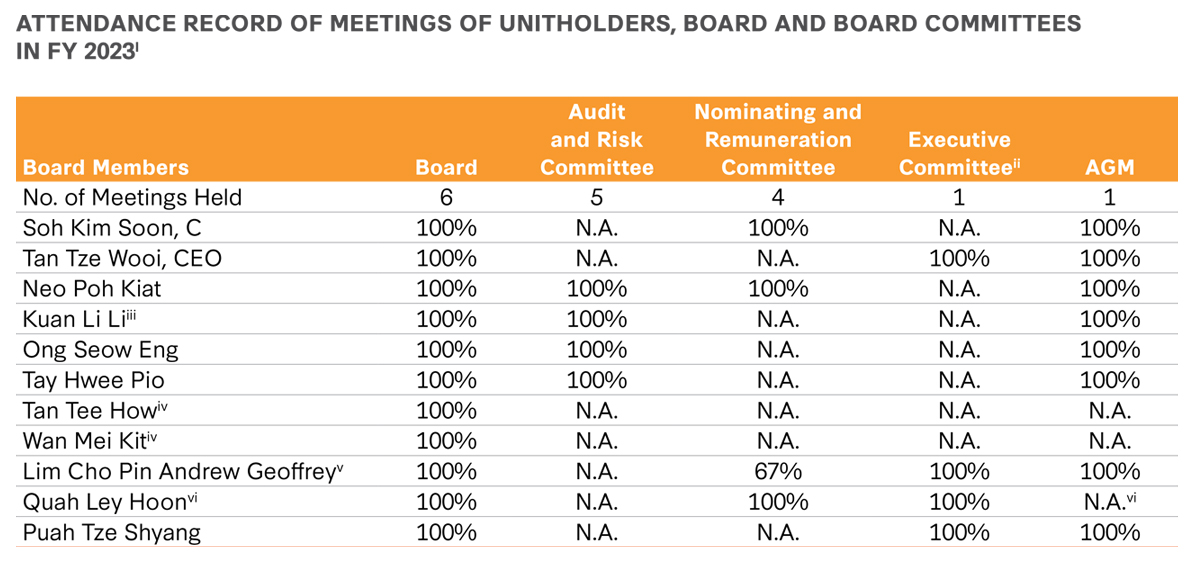

Furthermore, the Directors are required to act with due diligence in the discharge of their duties and they are responsible for ensuring that they have the relevant knowledge (including understanding CLCT’s business and the environment in which it operates) to carry out and discharge their duties as directors including understanding their roles as executive, non-executive, and independent directors. They are also required to dedicate the necessary effort, commitment and time to their work as directors, and are expected to attend all meetings of the Board, except if unusual circumstances make attendance impractical or if a Director has to recuse himself or herself from the meeting in relation to the sole matter under consideration at such meeting. All Directors currently on the Board as at the date of this Annual Report have attained a 100% attendance record for all Board and Board Committee meetings held in FY 2023.

Sustainability

The Manager places sustainability at the core of everything CLCT does and is committed to growing CLCT’s business in a responsible manner, delivering long-term economic value, and contributing to the environmental and social well-being of the communities where CLCT has a presence.

The Board recognises the importance of sustainability as a business imperative and is responsible for overseeing the development of sustainability strategies and plans, including providing guidance to Management and monitoring progress towards achieving the goals of any sustainability initiatives. This is consistent with the principle that the Board plays an important role in considering and incorporating sustainability considerations as part of CLCT’s strategy development. This also ensures that Environmental, Social and Governance (ESG) risks and opportunities are holistically integrated into CLCT’s long-term strategy. In this regard, sustainability is integrated into each phase of the real estate life cycle, and the CLCT Group’s operations, financing activities, support for the environment, business ethics, corporate governance and care for people and communities are anchored in CLCT’s ESG approach. The Board’s oversight of CLCT’s sustainability strategies and plans also sets the tone at the top to ensure the alignment of CLCT’s activities with its purpose and stakeholder interests.

CLCT reached numerous sustainability milestones during FY 2023 and the details of these accomplishments are set out under the “In Conversation with CEO” and “Sustainability Highlights” sections of this Annual Report. For more information regarding the Manager’s multi-faceted approach to sustainability management for CLCT, please refer to the “Sustainability Management” section of this Annual Report.

Directors’ Development

In view of the increasingly demanding, complex and multi-dimensional role of a Director, the Board recognises the importance of continual training and professional development for its Directors so as to equip them to discharge the duties and responsibilities of their office as Directors to the best of their abilities. The Nominating and Remuneration Committee has the responsibility to ensure that the Manager has in place a training and professional development framework to guide and support the Manager towards meeting the objective of having a Board which comprises individuals who are competent and possess up-to-date knowledge and skills necessary to discharge their duties and responsibilities. Directors who have no prior experience as a director of an issuer listed on the SGX-ST will be provided with training on the roles and responsibilities of a director of a listed issuer in accordance with the Listing Manual. The costs of training are borne by the Manager. The induction, training and development provided to new and existing Directors are set out below.

Each newly appointed Director is provided with a formal letter of appointment setting out the key terms of appointment, the time commitment expected, the Manager’s guidelines on the tenure of Directors and other relevant matters pertaining to the appointment. He or she also has access to the Director’s Manual which includes information on a broad range of matters relating to the role, duties and responsibilities of a Director and the Manager’s policies relating to disclosure of interests in securities, conflicts of interest and securities trading restrictions. All Directors, upon appointment, also undergo an induction programme which focuses on orientating the Director to CLCT’s business, operations, strategies, organisation structure, responsibilities of the key management personnel (namely, the CEO and other persons having executive roles with authority and responsibility for planning, directing and controlling the activities of the Manager), and financial and governance practices. Conducted by the CEO and other key executives of Management, the induction programme also provides opportunities for the new Director to get acquainted with members of Management which facilitates their interactions at Board meetings.

In compliance with Rule 210(5)(a) of the Listing Manual, where a newly appointed Director has no prior experience as a director of an issuer listed on the SGX-ST, such Director will undergo training on the roles and responsibilities of a director of a listed issuer. In this regard, Mr Tan Tee How has prior experience as a director of an issuer listed on the SGX-ST and Ms Quah Ley Hoon has completed the requisite training as at the date of this Annual Report. Further, Ms Wan Mei Kit has completed the Singapore Institute of Directors - Environmental, Social and Governance Essentials training as at the date of this Annual Report and will complete all of the remaining requisite training in FY 2024.

Following their appointment, the Directors are provided with opportunities for continuing education in areas such as director’s duties and responsibilities, regulatory updates, risk management and accounting standards and sustainability matters as prescribed by the SGX-ST. As at the end of FY 2023, all Directors had completed the training required under Rule 720(7) of the Listing Manual. The Directors may also request for training in areas related to CLCT’s business and corporate governance. The objective is to enable the Directors to be updated on matters that affect or go towards enhancing their performance as Directors or Board Committee members. Such opportunities are provided at the Manager’s expense. The Directors may also contribute by recommending to the Board specific training and professional development programmes which he or she believes would benefit the Directors or the Board as a whole.

The Manager also believes in keeping Board members updated and externally focused. The Directors are encouraged to attend training and professional development programmes which include forums and dialogues with experts and senior business leaders on issues facing boards and board practices. Sharing and information sessions by guest speakers and Management team members are organised as part of Board events and meetings. Such sessions typically include updates on business strategies and key industry developments and trends. Directors may also receive on a regular basis reading materials on topical matters or subjects and their implications for the CLCT Group’s business. In addition to regular Board briefings and highlights on areas such as ESG and risk management, smaller-group sessions will also be arranged if required to address the needs of particular Board members. These sessions facilitate the Board’s interaction with and provision of feedback to Management, which in turn enables the Manager to better organise programmes and information sessions to suit the needs of the Directors.

In FY 2023, the Directors attended various training and professional development programmes, forums and workshops. The training and professional development programmes attended by the Directors include the SID Directors Conference 2023, the SID Environmental, Social and Governance Essentials (Core) programme, as well as various other programmes and seminars organised by the REIT Association of Singapore and business partners in relation to sustainability matters. Sharing and information sessions were also organised as part of Board meetings, where guest speakers and Management team members presented on key topics to the Board. The Directors also regularly receive reading materials on topical matters or subjects as well as updates on regulatory changes and their implications.

Board Committees

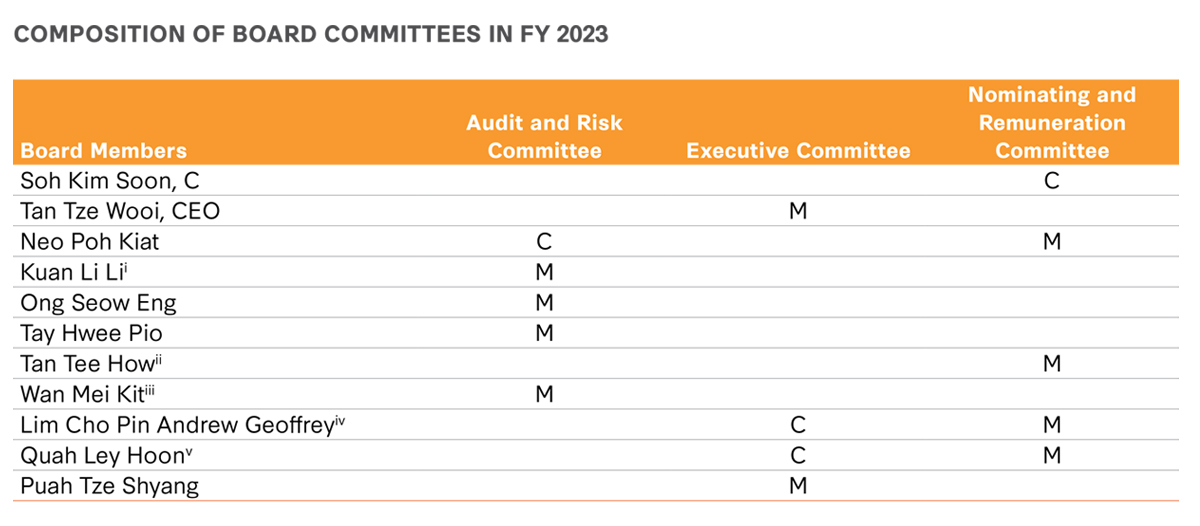

The Board has established various Board Committees to assist it in the discharge of its functions. These Board Committees are the Audit and Risk Committee (ARC), the Executive Committee (EC) and the Nominating and Remuneration Committee (NRC).

Each Board Committee is formed with clear written terms of reference (setting out its composition, authorities and duties, including reporting back to the Board) and operates under delegated authority from the Board with the Board retaining overall oversight. The chairpersons of these Board Committees report to the Board on a periodic basis regarding the decisions and significant matters discussed at the respective Board Committee meetings. The minutes of the Board Committee meetings which record the key deliberations and decisions taken during these meetings are also circulated to all Board members for their information. The duties and responsibilities of the various Board Committees are set out in this Report. The Board may form other Board Committees from time to time.

The composition of the various Board Committees as at the date of this Annual Report is set out in the Corporate Information section on the inside back cover of this Annual Report. The composition of each Board Committee is reviewed by the NRC regularly, and as and when there are changes to Board membership. Where appropriate, changes are made to the composition of the Board Committees, with a view to ensuring there is an appropriate diversity of skills and experience, and fostering active participation and contributions from Board Committee members.

Meetings of Board and Board Committees

Board and Board Committee meetings are scheduled prior to the start of each financial year in consultation with the Directors. In addition to scheduled meetings, ad hoc Board and Board Committee meetings are convened as required. The Constitution of the Manager permits the Directors to participate in Board and Board Committee meetings via audio or video conference. If a Director is unable to attend a Board or Board Committee meeting, he or she may provide his or her comments to the Chairman or the relevant Board Committee chairman ahead of the meeting and these comments are taken into consideration in the deliberations. The Board and Board Committees may also make decisions by way of written resolutions.

The non-executive Directors (which for the avoidance of doubt, exclude the CEO as he is an executive Director and part of Management), led by the independent Chairman or other independent Director as appropriate, also meet regularly about two times in a year without the presence of Management. In FY 2023, the non-executive Directors, led by the independent Chairman, met twice for discussions without the presence of Management. The chairman of these meetings was the independent Chairman and he provided feedback to all members of the Board and/or Management as appropriate.

At the scheduled Board meetings, the Board is apprised of the following:

- significant matters discussed at the ARC meeting which is typically scheduled before each Board meeting;

- the ARC’s recommendation on CLCT’s periodic and year-end financial results following the ARC’s review of the same;

- decisions made by Board Committees in the period under review;

- updates on the CLCT Group’s business and operations in the period under review, including market developments and trends, as well as business initiatives and opportunities;

- financial performance, budgetary and capital management related matters in the period under review, including any material variance between any projections in budget or business plans and the actual results from business activities and operations;

- any risk management issues that materially impact CLCT’s operations or financial performance;

- updates on key Unitholder engagements in the period under review, as well as analyst views and market feedback; and

- prospective transactions which Management is exploring.

This allows the Board to develop a good understanding of the progress of the CLCT Group’s business as well as the issues and challenges faced by CLCT, and also promotes active engagement with Management.

The Board adopts and practises the principle of collective decision-making and is able to achieve consensus on matters requiring its approval after robust debate. Prior to decision-making at Board and Board Committee meetings, all Directors actively participate in discussions, which include challenging assumptions, offering alternative scenarios, and testing Management’s vision on the relevant matter. The Board is able to achieve this as it benefits from a culture of open, frank, rigorous and constructive discussions and debates at Board and Board Committee meetings conducted on a professional basis. There is mutual respect and trust among the Directors. No individual Director influences or dominates the decision-making process.

Management provides the Directors with complete, adequate and timely information prior to Board and Board Committee meetings and on an ongoing basis. This enables the Directors to make informed decisions and discharge their duties and responsibilities.

As a general rule, meeting materials are provided to the Board and Board Committee members in advance of each Board and Board Committee meeting to allow them to prepare for the meetings and to enable them to focus discussions on any questions or issues that they may have or identify. Agendas for Board and Board Committee meetings are prepared in consultation with the Chairman and the chairmen of the respective Board Committees. This provides assurance that important topics and issues will be covered during the meetings. Half-year and full-year financial statements are reviewed by the ARC prior to recommendation to the Board for approval.

In line with the Manager’s ongoing commitment to minimise paper wastage and reduce its carbon footprint, the Manager does not provide printed copies of Board and Board Committee meeting materials. Instead, the Directors are provided with tablet devices to enable them to access and review soft copies of the meeting materials whether prior to or during meetings. This initiative also enhances information security as the meeting materials are made available through a secure channel. The Directors are also able to review and approve written resolutions using the tablet devices.

With a view to ensuring that the Board meets frequently enough to review all essential matters and make efficient and well-informed decisions, the Board meets at least once every financial quarter. During FY 2023, the Board held six Board meetings, including one held offsite to discuss strategy and five ARC meetings, four NRC meetings and one EC meeting were held. The key deliberations and decisions taken at Board and Board Committee meetings are recorded in writing in the minutes of meeting.

A record of the Directors’ attendance at general meeting(s) of Unitholders and Board and Board Committee meetings held in FY 2023 is set out on page 144 of this Annual Report.

The CEO, who is also a Director, attends all Board meetings. He also attends all EC meetings as a member and all ARC and NRC meetings on an ex officio basis. Other members of Management attend Board and Board Committee meetings as required to brief the Board and Board Committees on specific business matters.

There is active interaction between the Directors and Management during Board and Board Committee meetings, as well as outside of Board and Board Committee meetings, including Board-hosted lunches and dinners. The Directors have separate, independent and unfettered access to Management for any information that they may require. Likewise, Management has access to Directors outside the formal environment of Board and Board Committee meetings for any guidance that it may seek whenever a need arises. The Board and Management share a productive and harmonious relationship, which is critical for good governance and organisational effectiveness.

The Directors also have separate and independent access to the company secretary of the Manager (Company Secretary). The Company Secretary is legally trained, has oversight of corporate secretarial administration matters and provides advice to the Board and Management on corporate governance matters. The Company Secretary attends Board meetings and assists the Chairman in ensuring that Board procedures are followed. The Company Secretary also facilitates the induction programme for new Directors and oversees professional development administration for the Directors. The appointment and the removal of the Company Secretary is subject to the Board’s approval.

The Directors, whether individually or collectively as the Board, are entitled to have access to independent external professional advice where necessary, at the Manager’s expense.

-

Board Composition and Guidance

Principle 2: Board Composition and Guidance

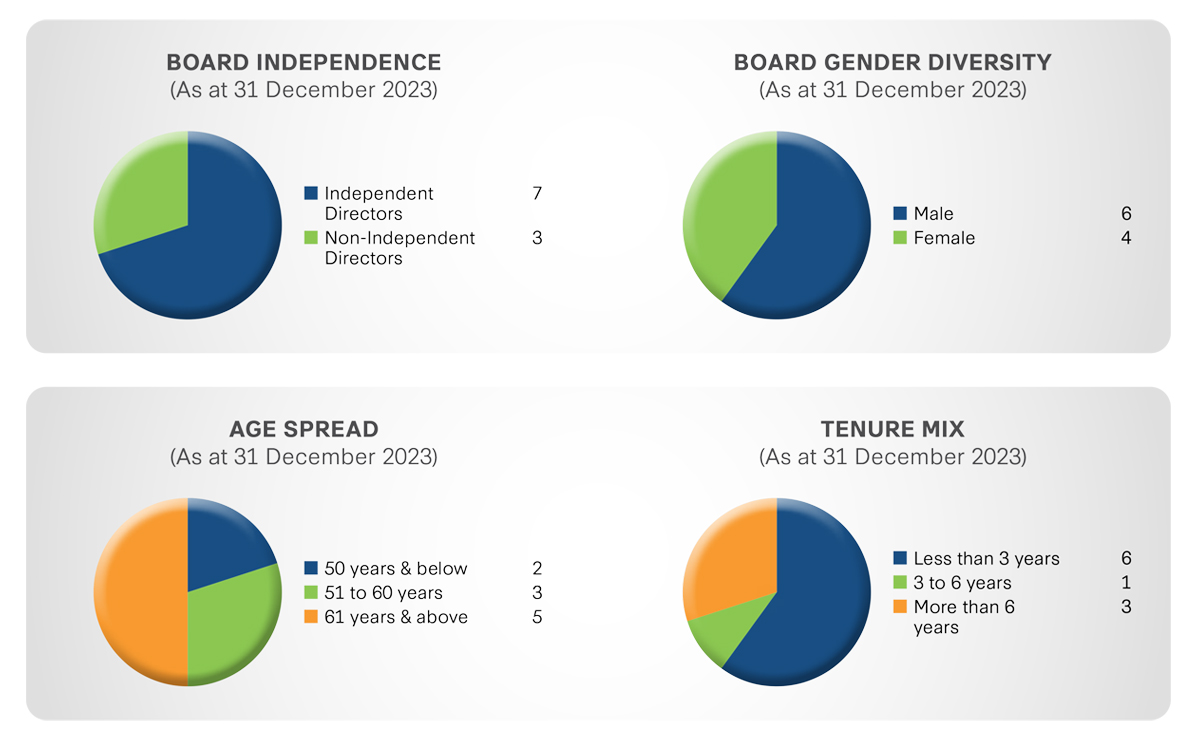

Board Independence

The Board has a strong independent element with a significant majority of non-executive IDs. As at the date of this Annual Report, six out of nine directors, including the Chairman, are non-executive IDs. Other than the CEO who is the only executive Director on the Board, non-executive Directors make up the rest of the Board. None of the IDs as at the date of this Annual Report have served on the Board for nine years or longer. No lead ID is appointed as the Chairman is an ID. Profiles of the Directors, their respective Board Committee memberships and roles are set out on pages 34 to 39 of this Annual Report. Key information on the Directors is also available on CLCT’s website (Website) at www.clct.com.sg.

The Board, through the NRC, reviews from time to time the size and composition of the Board and the Board Committees, with a view to ensuring that the size is appropriate in facilitating effective deliberations and decisionmaking, and the composition reflects an appropriate level of independence as well as diversity of thought and backgrounds. The review takes into account the scope and nature of the CLCT Group’s operations, the evolving external environment and the competition that the CLCT Group faces.

The Board, through the NRC, assesses annually (and additionally as and when circumstances require) the independence of each Director, taking into consideration the relevant relationships and circumstances, including those specified in the Listing Manual and the guidance in the Code, the Securities and Futures (Licensing and Conduct of Business) Regulations (SFR) and where relevant, the recommendations set out in the Practice Guidance accompanying the Code (Practice Guidance), that are relevant in the determination as to whether a Director is independent. A Director is considered independent if he or she is independent in conduct, character and judgement and:

- has no relationship with the Manager, its related corporations, its substantial shareholders, CLCT’s substantial Unitholders (being Unitholders who have interests in voting Units with 5% or more of the total votes attached to all voting Units) or the Manager’s officers that could interfere, or be reasonably perceived to interfere with the exercise of his or her independent business judgement in the best interests of CLCT;

- is independent from the management of the Manager and CLCT, from any business relationship with the Manager and CLCT, and from every substantial shareholder of the Manager and every substantial Unitholder of CLCT;

- is not a substantial shareholder of the Manager or a substantial Unitholder of CLCT;

- is not employed and has not been employed by the Manager or CLCT or their respective related corporations in the current financial year or any of the past three financial years;

- does not have an immediate family member who is employed or has been employed by the Manager or CLCT or their respective related corporations in the current financial year or any of the past three financial years and whose remuneration is or was determined by the Board; and

- has not served on the Board for a continuous period of nine years or longer.

There is a rigorous process to evaluate the independence of each ID. As part of the process:

- each ID provides information of his or her business interests and confirms on an annual basis that there are no relationships which interfere with the exercise of his or her independent business judgement with a view to the best interests of the Unitholders as a whole, and such information is then reviewed by the NRC; and

- the NRC also reflects on the respective IDs’ conduct and contributions at Board and Board Committee meetings, in particular, whether the relevant ID has exercised independent judgement in discharging his or her duties and responsibilities.

The NRC also reviews the independence of an ID as and when there is a change of circumstances involving the ID. In this regard, an ID is required to report to the Board when there is any change of circumstances which may affect his or her independence.

The NRC has carried out the assessment of the independence of the IDs for FY 2023 and made its recommendations to the Board for the Board’s consideration and determination of the independence of the IDs. The paragraphs below set out the outcome of the NRC’s assessment and the Board’s determination of independence based on the information available and having taken into account the views of the NRC. Each ID is required and had recused himself or herself from the NRC’s and Board’s respective deliberations on his or her independence.

In this section on Principle 2, the term “CLI group” refers to (i) CapitaLand Investment Limited, its subsidiaries; and/or (ii) REITs managed by CapitaLand Investment Limited’s subsidiaries.

Mr Soh Kim Soon

Mr Soh is a non-executive director and chairman of ORIX Leasing Singapore Limited and is also chairman of ORIX Investment and Management Private Limited (together, the ORIX Companies). The ORIX Companies have business relationships with CLI group for the various matters, namely (i) a lease from CLI group; and (ii) services provided to CLI group.

Mr Soh’s role in each of the ORIX Companies is non-executive in nature and he is not involved in the day-to-day conduct of the businesses of the ORIX Companies. He was not involved in the decision of the ORIX Companies to enter into business relationships with CLI group. All of the transactions with CLI group are conducted in the ordinary course of business, on an arm’s length basis and based on normal commercial terms.

The NRC has assessed that (i) the respective relationships above did not interfere with the exercise of Mr Soh’s independent business judgement in the discharge of his duties and responsibilities as a Director; and (ii) he has demonstrated independence in conduct, character and judgement in the discharge of his duties and responsibilities as a Director. Save for the relationships stated above, he does not have any other relationships and is not faced with any of the circumstances identified in the Code, SFR and Listing Manual, or any other relationships which may affect his independent judgement. Based on the above, the Board arrived at the determination that Mr Soh is an independent Director.

Mr Neo Poh Kiat

Mr Neo is a non-executive director of a few subsidiaries and associated corporations of Temasek. Mr Neo’s roles in these corporations are non-executive in nature and he is not involved in the day-to-day conduct of the business of these corporations. Mr Neo has confirmed that he serves on the Board in his personal capacity and not as a representative of Temasek and he is not under any obligation, whether formal or informal, to act in accordance with the directions of Temasek in relation to the affairs of the Manager and CLCT.

The NRC has assessed that (i) the respective relationships above did not interfere with the exercise of Mr Neo’s independent business judgement in the discharge of his duties and responsibilities as a Director; and (ii) he had demonstrated independence in conduct, character and judgement in the discharge of his duties and responsibilities as a Director. Save for the relationships stated above, he does not have any other relationships and is not faced with any of the circumstances identified in the Code, SFR and Listing Manual, or any other relationships which may affect his independent judgement. Based on the above, the Board arrived at the determination that Mr Neo is an independent Director.

Ms Kuan Li Li

Ms Kuan retired from the Board with effect from 1 January 2024. For completeness, based on information available to the Board, information is provided below regarding Ms Kuan’s independence during FY 2023.

During FY 2023, Ms Kuan was a non-executive director of Freemont Capital Pte. Ltd. (the “Freemont Company”) and AIG Asia Pacific Insurance Pte Ltd (the “AIG Company”). The Freemont Company and the AIG Company had business relationships with CLI group for various matters, including but not limited to (i) leases from CLI group; and (ii) provision of a range of corporate insurance plans and coverage to CLI group.

Ms Kuan’s role in each of the Freemont Company and the AIG Company was non-executive in nature and she was not involved in the day-to-day conduct of the businesses of the Freemont Company and the AIG Company. She was not involved in the decision of the Freemont Company or the AIG Company to enter into business relationships with CLI group. All of the transactions with CLI group were conducted in the ordinary course of business, on an arm’s length basis and based on normal commercial terms.

The NRC has assessed that (i) the respective relationships above did not interfere with the exercise of Ms Kuan’s independent business judgement in the discharge of her duties and responsibilities as a Director; and (ii) she had demonstrated independence in conduct, character and judgement in the discharge of her duties and responsibilities as a Director. Save for the relationships stated above, she did not have any other relationships and was not faced with any of the circumstances identified in the Code, SFR and Listing Manual, or any other relationships which might have affected her independent judgement. Based on the above, the Board arrived at the determination that Ms Kuan was an independent Director.

Professor Ong Seow Eng

Professor Ong provided ad hoc training services to CLI group in FY 2023. He has confirmed that he provided these ad hoc training services in his personal capacity and not as a representative of CLI and he is not under any obligation, whether formal or informal, to act in accordance with the directions of CLI in relation to the affairs of the Manager and CLCT.

The NRC has assessed that (i) the relationship above did not interfere with the exercise of Professor Ong’s independent business judgement in the discharge of his duties and responsibilities as a Director; and (ii) he had demonstrated independence in conduct, character and judgement in the discharge of his duties and responsibilities as a Director. Save for the relationship stated above, he does not have any other relationships and is not faced with any of the circumstances identified in the Code, SFR and Listing Manual, or any other relationships which may affect his independent judgement. Based on the above, the Board arrived at the determination that Professor Ong is an independent Director.

Mr Tan Tee How

Mr Tan is a non-executive director and chairman of National Healthcare Group Pte. Ltd. (the “NHG Company”). The NHG Company has business relationships with CLI group for various matters, including but not limited to leases from CLI group.

Mr Tan’s role in the NHG Company is non-executive in nature and he is not involved in the day-to-day conduct of the business of the NHG Company. He was not involved in the decision of the NHG Company to enter into business relationships with CLI group. All of the transactions with CLI group are conducted in the ordinary course of business, on an arm’s length basis and based on normal commercial terms.

Mr Tan is also a non-executive director of a subsidiary of Temasek. Mr Tan’s role in the corporation is nonexecutive in nature and he is not involved in the day-to-day conduct of the business of the corporation. Mr Tan has confirmed that he serves on the board in his personal capacity and not as a representative of Temasek and he is not under any obligation, whether formal or informal, to act in accordance with the directions of Temasek in relation to the affairs of the Manager and CLCT.

The NRC has assessed that (i) the respective relationships above did not interfere with the exercise of Mr Tan’s independent business judgement in the discharge of his duties and responsibilities as a Director; and (ii) he had demonstrated independence in conduct, character and judgement in the discharge of his duties and responsibilities as a Director. Save for the relationships stated above, he does not have any other relationships and is not faced with any of the circumstances identified in the Code, SFR and Listing Manual, or any other relationships which may affect his independent judgement. Based on the above, the Board arrived at the determination that Mr Tan is an independent Director.

Ms Wan Mei Kit

Ms Wan is a non-executive director of Singapore Pools Private Limited (the “SP Company”). The SP Company has business relationships with CLI group for various matters, including but not limited to leases from CLI group.

Ms Wan’s role in the SP Company is non-executive in nature and she is not involved in the day-to-day conduct of the business of the SP Company. She was not involved in the decision of the SP Company to enter into business relationships with CLI group. All of the transactions with CLI group are conducted in the ordinary course of business, on an arm’s length basis and based on normal commercial terms.

The NRC has assessed that (i) the relationship above did not interfere with the exercise of Ms Wan’s independent business judgement in the discharge of her duties and responsibilities as a Director; and (ii) she had demonstrated independence in conduct, character and judgement in the discharge of her duties and responsibilities as a Director. Save for the relationship stated above, she does not have any other relationships and is not faced with any of the circumstances identified in the Code, SFR and Listing Manual, or any other relationships which may affect her independent judgement. Based on the above, the Board arrived at the determination that Ms Wan is an independent Director.

The Board is of the view that as at the last day of FY 2023, each of Mr Soh, Mr Neo, Ms Kuan, Professor Ong, Mr Tan and Ms Wan was able to act in the best interests of CLCT and all Unitholders in respect of the period in which they served as Directors in FY 2023.

Ms Tay Hwee Pio

Ms Tay does not have any relationships and is not faced with any of the circumstances identified in the Code, SFR and Listing Manual, or any other relationships which may affect her independent judgement.

The NRC has assessed that Ms Tay has demonstrated independence in conduct, character and judgement in the discharge of her duties and responsibilities as a Director. Based on the above, the Board arrived at the determination that Ms Tay is an independent Director.

Non-independent Directors

The remaining Directors as at the date of this Annual Report, namely, Mr Tan Tze Wooi, Ms Quah Ley Hoon and Mr Puah Tze Shyang, are all employees of CLI group and are not considered to be independent.

Board Diversity

The Board embraces diversity and has in place a Board Diversity Policy which provides for the Board to comprise talented and dedicated Directors with a diverse mix of expertise, experience, perspectives, skills and backgrounds, with due consideration to diversity factors, including but not limited to, diversity in age, gender, tenure and business or professional experience.

The Board values the benefits that diversity can bring to the Board in its deliberations by avoiding groupthink and fostering constructive debate. Diversity enhances the Board’s decision-making capability and ensures that the Manager has the opportunity to benefit from all available talent and perspectives, which is essential to the effective governance of CLCT’s business and for ensuring long-term sustainable growth.

CLCT’s Board diversity targets, plans and timelines for achieving the targets and progress towards achieving the targets are described below. Further information on the progress achieved during FY 2023 can be found at “Board Composition and Renewal” under Principle 4 in this Report.

The NRC, in carrying out its duties of determining the optimal composition of the Board in its Board renewal process and addressing Board vacancies, considers candidates who bring a diversity of background and opinion and have the appropriate industry or related expertise and experience. In identifying possible candidates and making recommendations of board appointments to the Board, the NRC’s considerations include achieving an appropriate level of diversity in the Board composition having regard to diversity factors such as skills, experience, gender, age and tenure, as well as educational, business and professional backgrounds of its members.

In its annual review of the Board’s composition, the NRC expressly considers and includes a commentary to the Board on the subject of diversity, including gender diversity, in the composition of the Board. In this regard, the NRC has reviewed the size and composition of the Board and is of the opinion that the Board and Board Committees are of an appropriate size and comprise Directors who as a group provide the appropriate balance and diversity of skills, knowledge, experience, gender, age and tenure, taking into account CLCT’s Board diversity targets, plans and timelines, the objectives of the Board Diversity Policy and the CLCT Group’s business needs and plans, for effective decision-making and constructive debate.

In line with the Board Diversity Policy, the current Board as at the date of this Annual Report comprises nine members who are corporate and business leaders, and are professionals with varied backgrounds, expertise and experience including in accounting, finance, banking, capital markets, real estate, investment management, governance and the China market. The Board members bring with them the combination of skills, talents, experience and diversity required to serve the needs and achieve the plans of the CLCT Group.

For further information on the Board’s work in this regard, please refer to “Board Membership” under Principle 4 in this Report.

-

Chairman and Chief Executive Officer

Principle 3: Chairman and Chief Executive Officer

The roles and responsibilities of the Chairman and the CEO are held by separate individuals to ensure an appropriate balance of power, increased accountability, and greater capacity of the Board for independent decision-making, in keeping with the principles that there be a clear division of responsibilities between the leadership of the Board and Management and that no one individual has unfettered powers of decision-making. The non-executive independent Chairman, Mr Soh Kim Soon and the CEO, Mr Tan Tze Wooi do not share any family ties. The Chairman and the CEO enjoy a positive and constructive working relationship between them and support each other in their respective leadership roles.

The Chairman leads and oversees the performance of the Board and plays a pivotal role in creating and facilitating the conditions needed for the overall effectiveness of the Board, Board Committees and individual Directors. This includes setting the agenda of Board meetings in collaboration with the CEO, ensuring that the agenda takes full account of the important issues faced by CLCT and there is sufficient information and time at meetings to address all agenda items, as well as promoting open and constructive engagement and dialogue among the Directors as well as between the Board and the CEO at meetings. The Chairman also guides the Board through its decision-making process and ensures that the Board operates effectively as a whole.

The Chairman devotes considerable time to understanding the business of CLCT, including the issues and the competition that CLCT faces. He plays a significant leadership role by providing clear oversight, direction, advice and guidance to the CEO. He also maintains open lines of communication and engages with other members of Management regularly, and acts as a sounding board for the CEO and other members of Management on strategic and significant operational matters.

The Chairman also presides at the Annual General Meeting (AGM) each year and at other general meetings where he plays a crucial role in fostering constructive dialogue between the Unitholders, the Board and Management.

The CEO has full executive responsibilities to manage the CLCT Group’s business and to develop and implement policies approved by the Board.

The separation of the roles and responsibilities of the Chairman and the CEO, and the resulting clarity of roles provide a healthy professional relationship between the Board and Management, facilitate robust deliberations on the CLCT Group’s business activities and the exchange of ideas and views to help shape the strategic process.

As the roles of the Chairman and the CEO are held by separate individuals who are not related to each other, and the Chairman is an ID, no lead ID has been appointed. Moreover, the Board has a strong independent element as six out of nine directors (including the Chairman) as at the date of this Annual Report are non-executive IDs. There are also sufficient measures in place to address situations where the Chairman is conflicted as he is required to recuse himself from deliberations and abstain from voting on any matter that could potentially give rise to conflict. The foregoing is consistent with the intent of Principle 3 of the Code.

-

Board Membership

Principle 4: Board Membership

The Board has a formal and transparent process for the appointment and re-appointment of Directors, taking into account the need for progressive renewal of the Board. It has established the NRC which makes recommendations to the Board on all appointments to the Board and Board Committees. All Board appointments are made based on merit and approved by the Board.

As at the date of this Annual Report, the NRC comprises four non-executive Directors, three of whom (including the chairman of the NRC) are IDs. The four members on the NRC are Mr Soh Kim Soon (NRC chairman), Mr Neo Poh Kiat, Mr Tan Tee How and Ms Quah Ley Hoon. Mr Tan Tee How was appointed as a member of NRC on 1 January 2024. Ms Quah Ley Hoon succeeded Mr Lim Cho Pin Andrew Geoffrey who retired from the Board and concurrently as a member of NRC on 16 June 2023. The NRC met four times in FY 2023.

The NRC has also reviewed and approved various matters within its remit via circulating papers. Under its terms of reference, the NRC’s scope of duties and responsibilities includes:

- reviewing the structure, size and composition of the Board and Board Committees and formulating, reviewing and making recommendations to the Board on succession plans for Directors, in particular, the appointment and/or replacement of the Chairman and the CEO;

- reviewing and making recommendations to the Board on the process and criteria for the evaluation of the performance of the Board, Board Committees and individual Directors and the results of such evaluation annually;

- considering annually and as and when circumstances require, if a Director is independent; and

- considering and making recommendations to the Board on the appointment and re-appointment of Directors.

In addition to the above, the NRC and/or the Board as a whole is kept abreast of relevant matters relating to the review of succession plans relating to the key management personnel, in particular the appointment and/ or replacement of the key management personnel. While this is a partial deviation from Provision 4.1(a) of the Code which requires the NRC to make recommendations to the Board on relevant matters relating to the review of succession plans, in particular the appointment and/or replacement of the key management personnel, the Board is of the view that such matters could be considered either by the NRC or by the Board as a whole. This is accordingly consistent with the intent of Principle 4 of the Code.

In respect of the review of training and professional development programmes for the Board and the Directors, the Board is of the view that this should be a matter involving the views and feedback of all members of the Board. Hence, any Director may contribute by recommending to the Board specific training and development programmes which he or she believes would benefit the Directors or the Board as a whole. The review of training and professional development programmes for the Board and the Directors is done by the Board as a whole, and this function was not delegated to the NRC. This is consistent with the intent of Principle 4 of the Code, notwithstanding that the NRC was not specifically assigned to review and make recommendations to the Board on such matters.

Board Composition and Renewal

The Board, through the NRC, strives to ensure that the Board has an optimal and diverse blend of backgrounds, experience and knowledge in business and general management, expertise relevant to the CLCT Group’s business and track record, and that each Director can bring to the Board an independent and objective perspective to enable balanced and well-considered decisions to be made in the interests of the CLCT Group. The channels used in the search and nomination process for identifying appropriate candidates, and the channels via which the eventual appointee(s) were found, and the criteria used to identify and evaluate potential new directors, are set out below.

There is a structured process for determining Board composition and for selecting candidates for appointment as Directors. In undertaking its duty of reviewing and making Board appointment recommendations to the Board, the NRC considers different time horizons for purposes of succession planning. The NRC evaluates the Board’s competencies on a long-term basis and identifies competencies which may be further strengthened in the mid to long term to achieve CLCT’s strategy and objectives. As part of medium-term planning, the NRC seeks to refresh the membership of the Board progressively and in an orderly manner, whilst ensuring continuity and sustainability of corporate peformance. The NRC also considers contingency planning to prepare for sudden and unforeseen changes. In reviewing succession plans, the NRC has in mind CLCT’s strategic priorities and the factors affecting the long-term success of CLCT. The review includes planning ahead to fill one or more vacancies which may arise in the future. Board succession planning takes into account the need to maintain flexibility to effectively address succession planning and to ensure that the Manager continues to attract and retain highly qualified individuals to serve on the Board. The NRC aims to maintain an optimal Board composition by considering the trends affecting CLCT, reviewing the skills needed and identifying gaps, including considering whether there is an appropriate level of diversity of thought. The process ensures that the Board composition is such that the Board has capabilities and experience which are aligned with CLCT’s strategy and environment, and that there are non-executive Directors who have prior working experience in the sectors that CLCT is operating in. The process includes considerations that will provide an appropriate balance and contribute to the collective skills and competencies of the Board, such as (a) the current size and composition of the Board and Board committees; (b) the independence of potential ID candidates; (c) the suitability of potential candidates for appointment to various Board Committees; and (d) diversity factors such as business or professional experience, age and gender.

The Board supports the principle that Board renewal is a necessary and continual process, both for good governance and for ensuring that the Board has the skills, expertise, diversity and experience which are relevant to the evolving needs of the CLCT Group’s business.

Board succession planning is carried out through the annual review by the NRC of the Board’s composition as well as when a Director gives notice of his or her intention to retire or resign. The annual review takes into account, among other things, the requirements in the Listing Manual and the Code, feedback from individual Directors as well as the diversity targets and factors in the Board Diversity Policy. The outcome of that review is reported to the Board. The Board seeks to refresh its membership progressively and in an orderly manner, whilst ensuring continuity and sustainability of corporate performance. The Board also has in place guidelines on the tenure of Directors. The guidelines provide that an ID should serve for no more than a maximum of two threeyear terms and any extension of tenure beyond six years will be rigorously considered by the NRC in arriving at a recommendation to the Board, and will be on a yearly basis up to a period of nine years (inclusive of the initial two three-year terms served).

The NRC identifies suitable candidates for appointment to the Board. Searches for possible candidates are conducted through contacts and recommendations. In this regard, the Manager may rely on external consultants from time to time to assist the NRC in identifying candidates, to ensure that a diverse slate of candidates is presented for the NRC’s and the Board’s consideration.

Candidates are identified based on the needs of CLCT, taking into account the strategic priorities of CLCT and the relevant skills required. The candidates will be assessed against a range of criteria including their demonstrated business sense and judgement, skills and expertise, and market and industry knowledge (and may include elements such as financial, sustainability or other specific competency, geographical representation and business background) with due consideration to diversity, including but not limited to diversity in business or professional experience, age and gender. The NRC also considers the qualities of the candidates, in particular whether they are aligned to the strategic directions and values of CLCT, while assessing the candidates’ ability to commit time to the affairs of CLCT, taking into consideration their other current appointments or commitments. The NRC uses a board competency matrix as a guide in determining if there are gaps in the skills of the Board as a whole and if the skills, expertise and experience of a candidate would complement those of the existing Board members.

The NRC also assesses annually, and as and when circumstances require, if a director is independent, having regard to the circumstances set forth in Provision 2.1 of the Code. Directors disclose their relationships with the Manager, its related corporations, its substantial shareholders, CLCT's substantial Unitholders or the Manager's officers, if any, which may affect their independence, to the Board. For further information on the Board's determination in this regard, please refer to "Board Independence" under Principle 2 in this Report.

Whilst the Board believes that it has an optimal blend of backgrounds, experience, knowledge in business and general management, and expertise relevant to help CLCT deliver on its strategic priorities, it believes in planning for orderly succession as well as contingencies and is continually looking out for opportunities to fill future gaps in competencies and to renew the Board in a progressive manner.

Board Changes

As part of the Board renewal process: (a) Ms Quah Ley Hoon succeeded Mr Lim Cho Pin Andrew Geoffrey as a non-executive non-independent Director and chairman of the EC with effect from 16 June 2023; (b) Mr Tan Tee How was appointed as a non-executive ID with effect from 1 August 2023 and joined the NRC as a member with effect from 1 January 2024; (c) Ms Wan Mei Kit was appointed as a non-executive ID with effect from 1 October 2023 and joined the ARC as a member with effect from 1 January 2024; and (d) Ms Kuan Li Li retired as a nonexecutive ID on 31 December 2023 after completing six consecutive years of service, concurrently relinquishing her role as a member of the ARC. These appointments enable the Board to achieve or, as the case may be, make significant progress towards achieving the diversity targets as set out at “Board Composition and Guidance” under Principle 2 in this Report.

Review of Directors’ Ability to Commit Time

In view of the responsibilities of a Director, Directors need to be able to devote sufficient time and attention to adequately perform their duties and responsibilities. The NRC conducts a review of the other appointments and commitments of each Director on an annual basis and as and when there is a change of circumstances involving a Director which may affect his or her ability to commit time to the Manager. In this regard, Directors are required to report to the Board any changes in their other appointments or commitments.

In reviewing whether a Director has adequately discharged his or her duties to the Manager and a Director’s ability to commit time to the affairs of the Manager, the NRC and the Board will consider if the Director’s total number of listed issuer board appointments is within the guidelines of major proxy advisor firms. In respect of the Directors’ other appointments and commitments, the Board takes the view that the number of listed company directorships that an individual may hold should be considered on a case-by-case basis, as a person’s available time and attention may be affected by many different factors, such as his or her individual capacity, whether he or she is in full-time employment, the nature of his or her other responsibilities and his or her near-term plan regarding some of the other appointments. A Director with multiple directorships is expected to ensure that he or she can devote sufficient time and attention to the affairs of the Manager. IDs are also required to consult the Chairman before accepting any invitation for appointment as a director of another entity or offer of a full-time executive appointment. Such a consultation will enable any concerns relating to the Director’s ability to commit time to the affairs of the Manager, as well as any potential conflicts of interest, to be shared and addressed. The Chairman will make the requisite assessment and consult with the NRC as necessary.

There is also no alternate director to any of the Directors. In keeping with the principle that a Director must be able to commit time to the affairs of the Manager, the Board has adopted the principle that it will generally not approve the appointment of alternate directors to the Directors.

Each of the Directors is required to make his or her own self-assessment and confirm that he or she is able to devote sufficient time and attention to the affairs of the Manager. For FY 2023, all non-executive Directors had undergone the self-assessment and provided the confirmation.

On an annual basis and, where appropriate when there is a change of circumstances involving a Director, the NRC assesses each Director’s ability to commit time to the affairs of the Manager. In the assessment, the NRC takes into consideration each Director’s confirmation, his or her commitments, attendance record at meetings of the Board and Board Committees, as well as conduct (including preparedness, participation and level of engagement) and the value and quality of their contributions at Board and Board Committee meetings.

The Directors’ listed company directorships and principal commitments are disclosed on pages 35 to 39 of this Annual Report and their attendance records for FY 2023 are set out on page 144 of this Annual Report. In particular, the CEO does not serve on any listed company board outside of the CLCT Group. For FY 2023, the Directors achieved high meeting attendance rates and each Director has participated and been engaged in, and has contributed to discussions and deliberations at Board and Board Committee meetings. Based on the above, the NRC (with each NRC member recusing himself or herself from approving the determination in respect of himself or herself) has determined that each Director is able to commit time to the affairs of the Manager and CLCT, and is able to and has been adequately carrying out his or her duties as a Director. The NRC and the Board have noted that no Director has a significant number of listed directorships and principal commitments.

-

Board Performance

Principle 5: Board Performance

The Manager believes that oversight from a strong and effective Board goes a long way towards guiding CLCT’s success. Whilst Board performance is ultimately reflected in the long-term performance of the CLCT Group, the Board believes that engaging in a regular process of self-assessment and evaluation of Board performance provides an opportunity for the Board to reflect on its effectiveness including the quality of its decisions, and for Directors to consider their performance and contributions. It also enables the Board to identify key strengths and areas for improvement which are essential to effective stewardship and attaining success for CLCT, in addition to improving working relationships with Management.

The NRC recommends for the Board’s approval the objective performance criteria, and the Board undertakes a process to evaluate the effectiveness of the Board as a whole and that of each of its Board Committees and individual Directors for every financial year. As part of the process, a questionnaire is sent to the Directors. The evaluation results are aggregated and reported to the NRC, and thereafter to the Board. The findings are considered by the Board and follow-up action is taken where necessary with a view to enhancing the effectiveness of the Board, Board Committees and individual Directors in the discharge of its and their duties and responsibilities. As and when required, external facilitators may be appointed to assist in the evaluation process of the Board, Board Committees and the individual Directors. For FY 2023, the evaluation process was conducted without involving any external facilitator.

Board and Board Committees

The evaluation categories covered in the questionnaire include Board composition, Board processes, strategy, performance and governance, access to information and Board Committee effectiveness. As part of the questionnaire, the Board also considers whether the creation of value for Unitholders has been taken into account in the decision-making process. For FY 2023, the outcome of the evaluation was satisfactory and the Directors generally received affirmative ratings across the evaluation categories for the Board as a whole and for each Board Committee that was evaluated. Management has also provided positive feedback on the performance of the Board.

Individual Directors

The evaluation categories covered in the questionnaire include Director’s duties, contributions, conduct and interpersonal skills, as well as strategic thinking and risk management. For FY 2023, the outcome of the evaluation was satisfactory and each of the Directors generally received affirmative ratings across the evaluation categories.

The Board also recognises that contributions by an individual Director can take different forms including providing objective perspectives on issues, facilitating business opportunities and strategic relationships, and accessibility to Management outside of the formal environment of Board and Board Committee meetings.

Board Evaluation as an Ongoing Process

The Board believes that performance evaluation should be an ongoing process and the Board achieves this by seeking feedback on a regular basis. The regular interactions between the Directors, and between the Directors and Management, also contribute to this ongoing process. Through this process of engaging its members, the Board also benefits from an understanding of shared norms between Directors which also contributes to a positive Board culture. The collective Board performance and the contributions of individual Directors are also reflected in, and evidenced by, the synergistic performance of the Board in discharging its responsibilities as a whole by providing proper guidance, diligent oversight and able leadership, lending support to Management in steering CLCT in the appropriate direction, as well as the long-term performance of CLCT whether under favourable or challenging market conditions.

(B) REMUNERATION MATTERS

Principles 6, 7 and 8: Procedures for Developing Remuneration Policies, Level and Mix of Remuneration and Disclosure on Remuneration

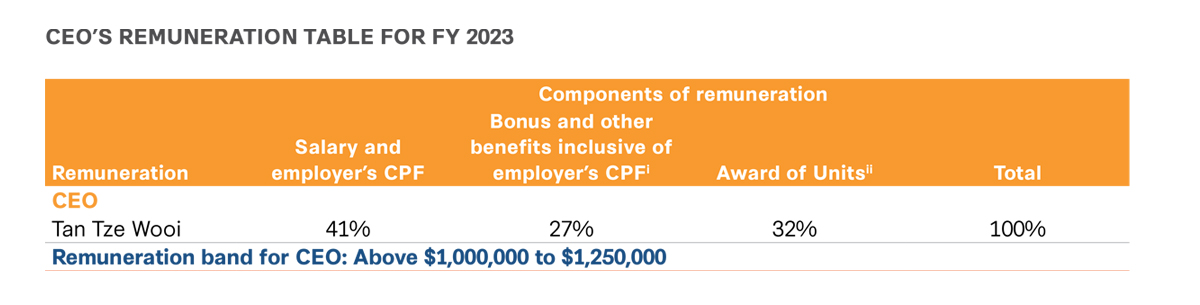

All fees and remuneration payable to Directors, key management personnel (including the CEO) and staff of the Manager are paid by the Manager.

The Board has a formal and transparent procedure for developing policies on Director and executive remuneration, and for fixing the remuneration packages of individual Directors and key management personnel. No Director is involved in deciding his or her own remuneration.

The Board has established the NRC and under its terms of reference, the NRC's scope of duties and responsibilities in relation to remuneration matters include reviewing and determining:

- the Board remuneration framework and the specific remuneration packages for the Directors; and

- the compensation framework and the specific remuneration packages for the CEO and other key management personnel.

While Provision 6.1 of the Code provides for the NRC to make recommendations to the Board on such matters, the Board is of the view that such matters are best reviewed and determined by the NRC as part of its focused scope, and has delegated the decision-making on such matters to the NRC. The NRC reports any decisions made on such matters to the Board. This is accordingly consistent with the intent of Principle 6 of the Code.

Guided by its terms of reference, the NRC oversees the development and succession planning for the CEO. This includes overseeing the process for the selection of the CEO and conducting an annual review of career development and succession matters for the CEO.

For further information on the composition of the NRC, please refer to “Board Membership” under Principle 4 in this Report.

Remuneration Policy for Key Management Personnel

The remuneration framework and policy are designed to support the implementation of the CLCT Group’s business strategy and deliver sustainable value to Unitholders. The principles governing the remuneration policies of the Manager’s key management personnel are as follows:

Business Alignment

- Focus on generating rental income and enhancing asset value over time so as to maximise returns from investments, and ultimately the distributions and total returns to Unitholders

- Provide sound and structured funding to ensure affordability and cost-effectiveness in line with performance goals

- Enhance retention of key talents to build strong organisational capabilities

- Strengthen alignment to ESG practices

Motivate Right Behaviour

- Pay for performance - align, differentiate and balance rewards according to multiple dimensions of performance

- Strengthen line-of-sight linking rewards and performance

Fair & Appropriate

- Ensure competitive remuneration relative to the appropriate external talent markets

- Manage internal equity such that remuneration is viewed as fair across the CLCT Group

- Significant and appropriate portion of pay-at-risk, taking into account risk policies of the CLCT Group, symmetrical with risk outcomes and sensitive to the risk time horizon

Effective Implementation

- Maintain rigorous corporate governance standards

- Exercise appropriate flexibility to meet strategic business needs and practical implementation considerations

- Facilitate employee understanding to maximise the value of the remuneration programme

These remuneration policies are in line with the CLCT Group’s business strategy and the executive compensation framework is based on the key principle of linking pay to performance, which is emphasised by linking total remuneration to the achievement of business and individual goals and objectives. The NRC considers all aspects of remuneration, including termination terms, to ensure they are fair, and has access to remuneration consultants for advice on remuneration matters as required.

In reviewing policies on remuneration and determining the remuneration packages for key management personnel, the NRC, through an independent remuneration consultant, takes into consideration appropriate compensation benchmarks within the industry, so as to ensure that the remuneration packages payable to key management personnel are competitive and in line with the objectives of the remuneration policies. It also considers the compensation framework of CLI as a point of reference. The Manager is a subsidiary of CLI which also holds a significant stake in CLCT. The association with the CLI group puts the Manager in a better position to attract and retain better qualified management talent. Additionally, it provides an intangible benefit to the Manager in that it allows its employees to associate themselves with an established corporate group which can offer them the depth and breadth of experience and enhanced career development opportunities.

In FY 2023, Willis Towers Watson was appointed as independent remuneration consultant to provide professional advice on executive remuneration. Willis Towers Watson is a leading global advisory, broking and solutions company with over 46,000 employees serving more than 140 countries and markets. The consultant is not related to the Manager, its controlling shareholder, its related corporations or any of its Directors.

Remuneration of Key Management Personnel

The remuneration of key management personnel comprises fixed components, a variable component, long-term components and employee benefits. A significant proportion of key management personnel’s remuneration is in the form of variable compensation, awarded in a combination of short-term, deferred and long-term incentives, in keeping with the principle that the interests of the key management personnel should be aligned with those of Unitholders and that the remuneration framework should link rewards to business and individual performance and promote the long-term success of CLCT.

A. Fixed Components:

The fixed components comprise the base salary, fixed allowances and compulsory employer contribution to an employee’s Central Provident Fund.

B. Variable Component:

The variable component is derived from the Performance Bonus Plan (PBP). It is linked to the achievement of annual performance targets for each key management personnel’s annual performance targets as set in their Balanced Scorecard (BSC).

Under the Balanced Scorecard framework, the CLCT Group’s strategy and goals are translated to performance outcomes comprising both quantitative and qualitative targets in the dimensions of:

-

REIT Performance

This includes targets relating to profitability and distributions, investor outreach and communication, capital structure, as well as financial and risk management

-

Preparing for Future

This includes targets relating to asset performance and occupancy, assets enhancements and capital recycling

-

Sustainability

This includes targets relating to talent retention, succession planning and sustainable corporate practices (including workplace safety)

-

Manager's Financial Health

This includes targets relating to the Manager’s financial viability and efficiency

These Balanced Scorecard targets are approved by the Board and cascaded down throughout the organisation, thereby creating alignment across the CLCT Group.

After the close of each financial year, the Board reviews the CLCT Group’s achievements against the targets set in the Balanced Scorecard and determines the overall performance taking into consideration qualitative factors such as the quality of earnings, operating environment, regulatory landscape and industry trends.

In determining the payout quantum for each key management personnel under the PBP, the NRC considers the overall business and individual performance as well as the affordability of the payout to the Manager. The PBP is delivered in a combination of cash and deferred Units with employees in senior management grades receiving a greater proportion of their PBP payout in deferred Units. These time-based Units are awarded pursuant to the CapitaLand China Trust Management Limited Restricted Unit Plan (RUP) and will vest in three equal annual tranches without further performance conditions. Recipients will receive fully paid Units, their equivalent cash value or combinations thereof, at no cost. These Units awards ensure ongoing alignment between remuneration and sustainable business performance.

C. Long-Term Components:

The long-term components comprise CapitaLand China Trust Management Limited Performance Unit Plan (PUP) and CapitaLand China Trust Management Limited Restricted Unit Plan (RUP), together the “Unit Plans”. Unit awards were granted in FY 2023 pursuant to the PUP. The Manager believes that the Unit-based components of the remuneration for key management personnel serve to align the interests of such key management personnel with that of Unitholders and CLCT’s long-term growth and value. The obligation to deliver the Units is satisfied out of existing Units held by the Manager.

To promote the alignment of Management’s interests with that of Unitholders in the longer term, senior members of Management are subject to Unit ownership guidelines to instill stronger identification with the longer-term performance and growth of the CLCT Group. Under these guidelines, senior members of Management are required to retain a prescribed proportion of the Units received under the Unit Plans worth up to at least one year of basic salary.

Units vested pursuant to the Unit Plans may be clawed back in circumstances where the relevant participants are found to be involved in financial misstatement, misconduct, fraud or malfeasance to the detriment of the CLCT Group.

CapitaLand China Trust Management Limited Performance Unit Plan

In FY 2023, the NRC granted awards which are conditional on targets set for a three-year performance period. A specified number of Units will only be released to the recipients at the end of the qualifying performance period, provided that minimally the threshold target is achieved.